First Growths as Inflation Hedge

It's about time that you think of the best wines as liquid yet hard assets. Extraordinary times call for extraordinary insights. 2022 has been a tough year for investors. Bonds and stocks have sold off in tandem. Real estate is also starting to wobble. Have you got wine in your portfolio?

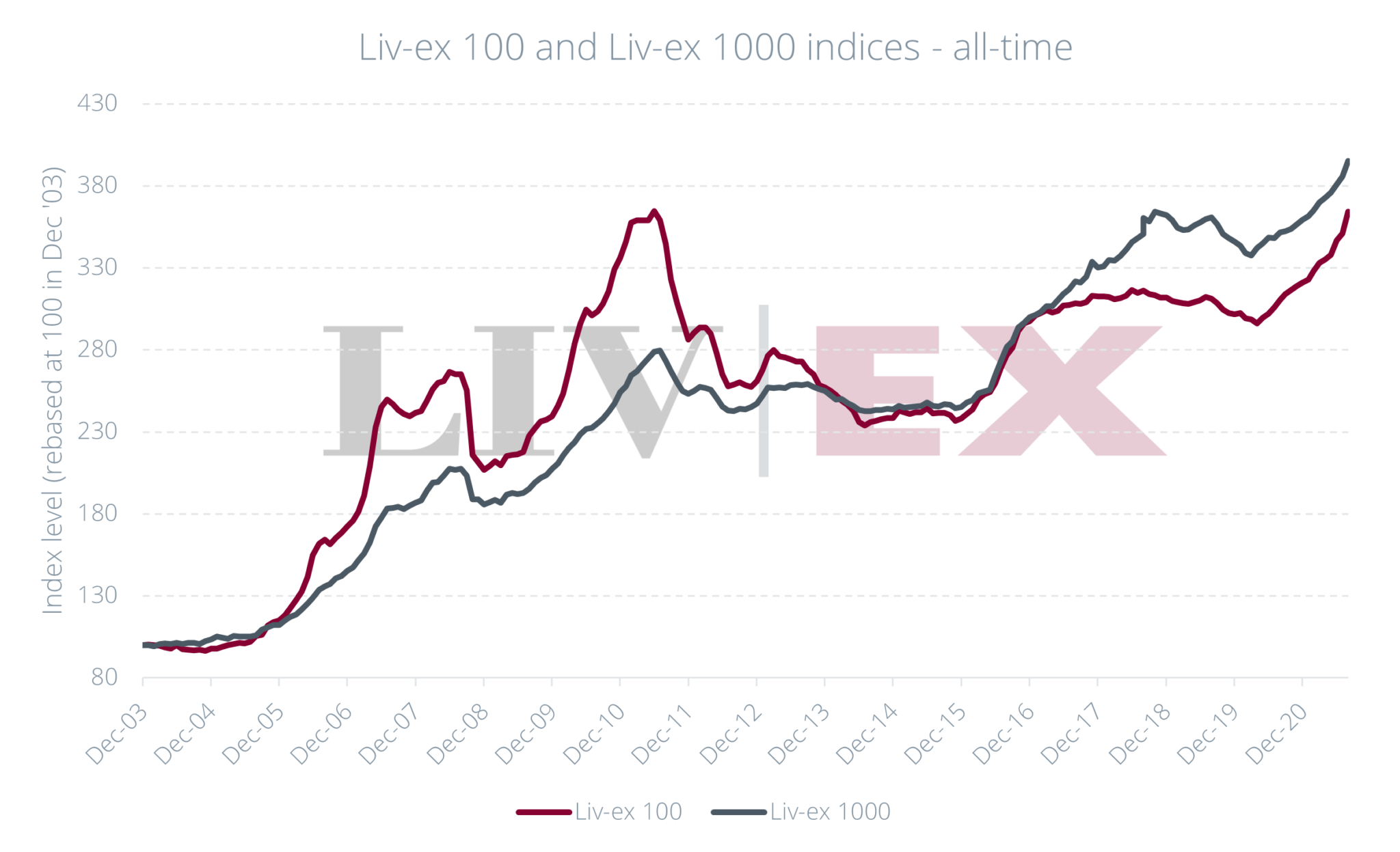

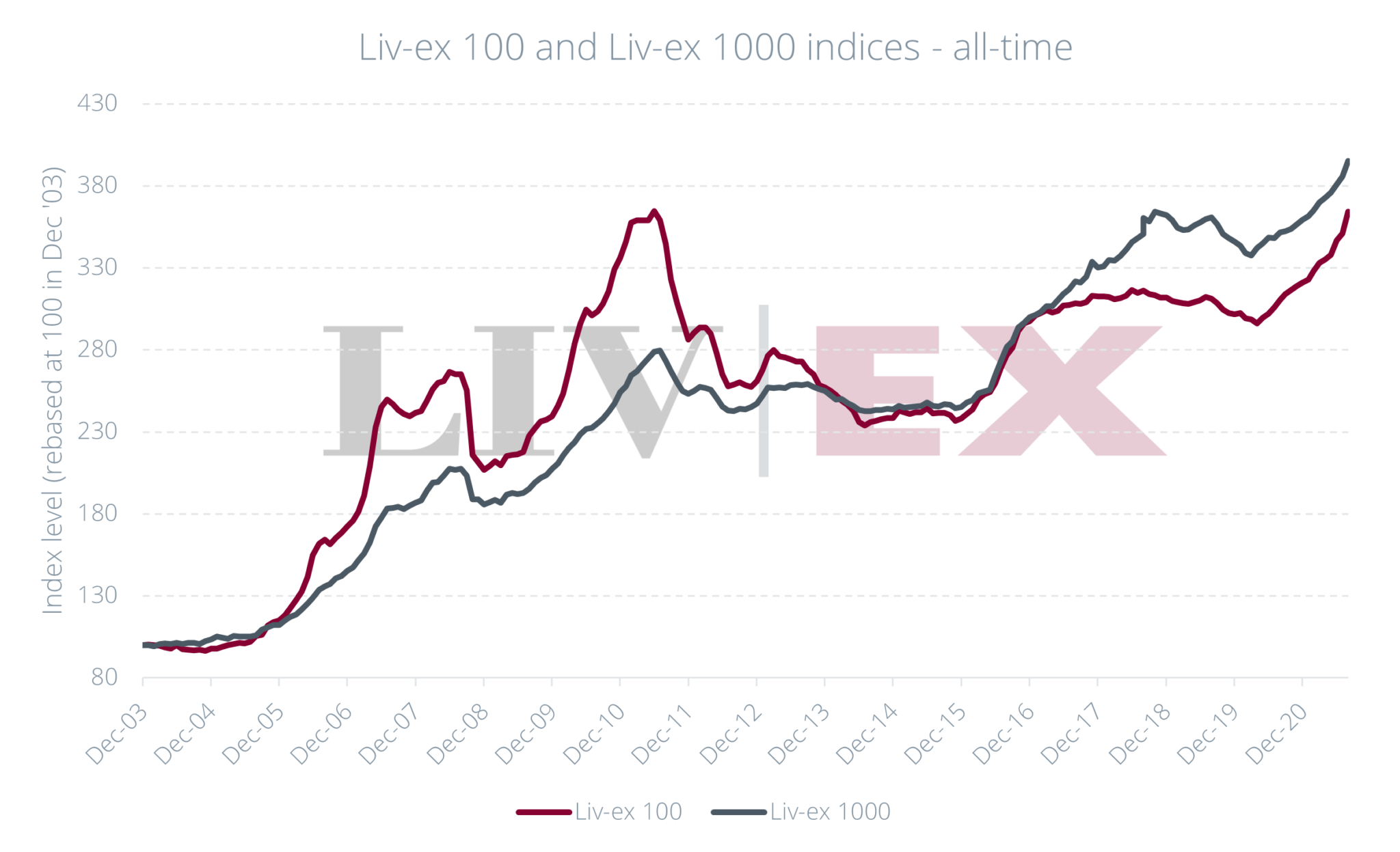

Last weekend (August 6 & 7), the Financial Times published an article on the front page highlighting that fine wine is passing the test as hedge against inflation. If you wonder how fine wine has performed over the past 20 years, here’s a chart by Liv-ex showing two indices: one is a basket of the top 100 wines, the other is a basket of the top 1000 wines. Both have performed positively.

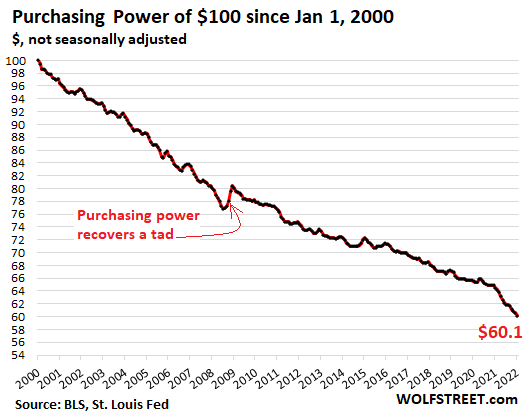

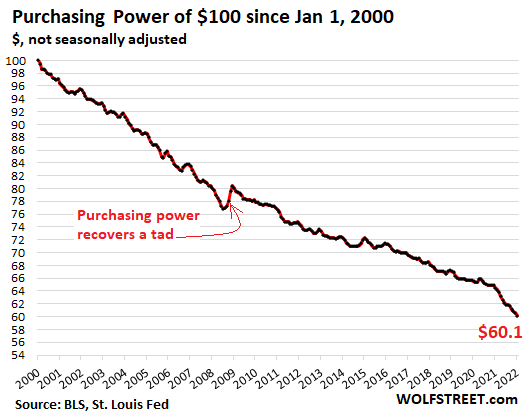

A separate study of an index of fine wine over the last 30 years has shown that wine has delivered a 10% compounded annual return. For comparison, here’s a chart showing how the purchasing power of US dollar has held up since 2000, according data from BLS and St. Louis Fed.

What is the rising price and value of fine wine telling us?

First, the law of supply and demand is working as expected. Of any specific vintage of fine wine, the supply keeps dwindling (as people open the bottles and consume the wine) even if the demand doesn’t change. If a wine critic raises the score of a wine that has aged, as history has shown, the demand usually shoots up, as is its price.

Secondly, all things being equal, inflation is part of our life even when the official numbers don’t tell it. Currently, the official numbers are showing extraordinarily high inflation, the highest in the last 40 years. They are going even higher. The Bank of England forecasted the inflation in UK (currently at 9.4%) to hit 13% by the end of the year. In the US, official inflation was at 9.1% last month. An update is scheduled for later this week. The forecast is not optimistic. In Canada, last official number was 8.1%. In Euro area, it is 8.9%.

The Fed wants us to believe it has the inflation under control. Sadly, that's cold comfort amid hot inflation. These are the same people who told us last year that inflation was transitory. The purchasing power of the dollar over the long term tells us the Fed’s promise needs to be taken with a large grain of salt. The unstated official position is to inflate some of our society’s problems away over time. They just can't admit it.

A smart investor needs a diversified, long-term approach to protect his/her purchasing power and investments. If appropriate for one’s specific financial needs, wine has a role to play in the investment portfolio. It is one asset that no central bank has the ability to print out of thin air!

To increase the margin of safety, a mini portfolio consisting of the First Growths of Bordeaux should perform better over time than a broader basket. To make the process of investing in the finest of Bordeaux easier, we present the ultimate selection of the top 7 First Growths from both the Left and the Right Bank. This selection is designed for customers who want to purchase all the First Growths in one single order. Buyer can either choose physical delivery when the wine is bottled, or opt for Laguna Cellar to broker the sale of the whole package to another buyer.

Since 2012, Château Latour has chosen to release its wine at a later date than others. It is why Château Latour is not included in this package at this time. However, buyers of this selection of First Growths will have priority to allocation when Château Latour becomes available.